Keep-It-Simple Financial Planning (Part 3)

This article is the third in a series of financial planning. You might want to go back and read Keep-It-Simple Financial Planning (Part 1) and Keep-It-Simple Financial Planning (Part 2) before continuing. This article talks about budgeting, and you may find it easier to follow if you read the earlier parts first.

Your budget will help determine how much extra you can afford to pay in order to get out of debt. According to The Richest Man in Babylon, “Save at least 1/10th of your income, and invest it.” The idea is to grow an estate for your future and your family. Becoming familiar with anything you invest in is equally important.

The first step in creating a budget is gathering your financial information:

- Income

- Expenses

Regular income includes paychecks or recurring income sources.

Irregular income includes money received regularly but not in fixed amounts, such as small business profits.

A simple way to forecast irregular income is to average the last 12 months. This gives a practical estimate while allowing excess income to buffer lean months.

Next, organize your expenses. Some occur monthly, others less frequently. Decide whether to budget a monthly portion for irregular bills or plan for them separately when they occur.

Review your budget each payday. Ask whether it reflects reality and whether every dollar has been assigned a purpose. Money without direction tends to disappear.

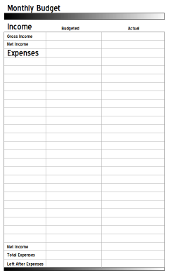

I created a monthly budget sheet to support this process. It contains blank expense lines so you can build categories that fit your life. Examples include:

Housing and Utility Expenses

- Mortgage or rent

- Insurance

- Taxes

- Electric

- Natural gas

- Water

- Garbage

Common Household Expenses

- Groceries

- Cleaning supplies

- Laundry

- Dry cleaning

- Home improvement

- Towels and linens

- Clothing

Transportation

- Car payments

- Insurance

- Fuel

- Maintenance

- Repairs

- Travel

- Public transportation

Entertainment

- TV or streaming

- Dining out

- Events

- Clubs

Communication

- Telephone

- Internet

- Cellular

Health and Beauty

- Haircuts

- Medical and dental

- Prescriptions

- Supplements

Debt

- Credit cards

- Loans

Other Possible Items

- Child care

- Allowances

- Subscriptions

- Fast food

- Investments

- Vacation

- Spending money

- Donations

- Gifts

- Emergency fund

- Personal habits

Now do the math. Add total income. Add total expenses. Subtract expenses from income.

If the result is zero, your plan is balanced.

If positive, choose whether to save, invest, or accelerate debt repayment.

If negative, expenses need trimming — starting with non-essentials.

The final step is separating money by purpose using envelopes or accounts. Many people prefer cash envelopes because the physical limit reinforces discipline.

For those who write many checks, consider a dedicated account used only when issuing checks. Deposit the funds before writing the check and leave them until it clears. This prevents accidental overdrafts.

Downloads

Originally posted to D*I*YPlanner.

Subscribe via RSS